Arista Strategy

Virgo creates or builds niche, asset-based platform companies, including internally managed strategies (such as Zephyrus and Kavanah).

Feb 2014

Niche Industrials

Internally managed strategy. In-house aviation platform focused on the acquisition of mid-life aircraft assets on remaining 1-4 year 'stub' leases with projected engine trade or aircraft lease & trade exits.

VISIT SITE

Apr 2014

Specialty Finance

Founded in 2010 and headquartered in Atlanta, Georgia, NOW provides business to business credit financing solutions enabling companies to manage liquidity and growth more effectively.

VISIT SITE

.jpg)

Jul 2019

Specialty Finance

Transverse is a fully-licensed and rated fronting carrier, serving the Managing General Agent (MGA) market. It is a type of insurance company that acts like a specialty finance company to other insurance companies.

Note: The investment listed is "realized" or "sold" in which Virgo-managed funds previously held an investment interest and have since exited. This past investment is provided for illustrative purposes only and should not be viewed as an indication of future performance or expected return.

VISIT SITE

May 2014

Real Estate

Internally managed strategy. In-house real estate finance platform that seeks small balance loan originations with a focus on highly structured and off-the-run deals where there is some collateral or loan structure complexity, or where speed and flexibility can result in compelling risk/return. Kavanah also targets operating businesses in out-of-favor or growth sectors that have material real estate collateral.

Jan 2014

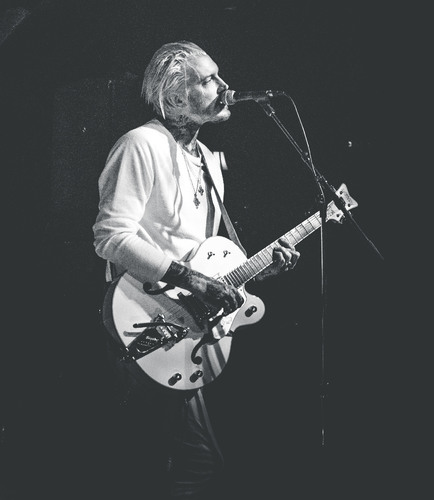

Media

Founded in 2001 and headquartered in Nashville, Tennessee, Combustion is the leading, independent music publisher of Country Music in the US.

Note: The investment listed is "realized" or "sold" in which Virgo-managed funds previously held an investment interest and have since exited. This past investment is provided for illustrative purposes only and should not be viewed as an indication of future performance or expected return.

VISIT SITE PLAY VIDEO

Oct 2013

Media

Founded in 2018 and headquartered in NY, New York, One77 is a boutique music publishing company created by Virgo in partnership with a veteran Chief Creative Officer to: (i) acquire and expand existing music publishing catalogs, (ii) provide artist financings (creation of new music copyrights) along with artist songwriting development, and (iii) execute creative administration deals (enhanced management of non-owned artist catalogs).

Note: The investment listed is "realized" or "sold" in which Virgo-managed funds previously held an investment interest and have since exited. This past investment is provided for illustrative purposes only and should not be viewed as an indication of future performance or expected return.

VISIT SITE

Nov 2013

Specialty Finance

Founded in 1989 and headquartered in Troy, Michigan, LCA is a full-service equipment finance company specializing in technology and industrial equipment financing. Since inception, LCA has booked and serviced over 88,000 leases, with an original equipment cost of over $1.2 billion.

Note: The investment listed is "realized" or "sold" in which Virgo-managed funds previously held an investment interest and have since exited. This past investment is provided for illustrative purposes only and should not be viewed as an indication of future performance or expected return.

VISIT SITE

Oct 2017

Specialty Finance

Founded in 2016 and headquartered in Chicago, Illinois, Stonegate Capital Holdings, LLC provides creative, asset-backed financing solutions to lower-middle market companies.

Note: The investment listed is "realized" or "sold" in which Virgo-managed funds previously held an investment interest and have since exited. This past investment is provided for illustrative purposes only and should not be viewed as an indication of future performance or expected return.

VISIT SITE PLAY VIDEO